Support - frequently asked questions

Invoice : cancel correctly

There are 2 different ways to cancel an invoice:1. Credit: You write a credit and deposit an incoming payment on the credit. The customer's account balance then shows 0 euros again, since the amount of the invoice and the credit note are offset. The easiest way to create the credit note is to select the receipt under "Offers and receipts", then right-click to select "Use invoice as template" and change the receipt type from invoice to credit note in the new receipt on the right-hand side. This means you don't have to type in the positions again.

2. Invoice cancellation: You select the invoice receipt under "Offers and receipts", then right-click on the receipt and select "Create cancellation for invoice". In this way you create a so-called "invoice cancellation" which automatically and completely offsets the invoice. An invoice can only be canceled as long as there is no receipt of payment on the invoice.

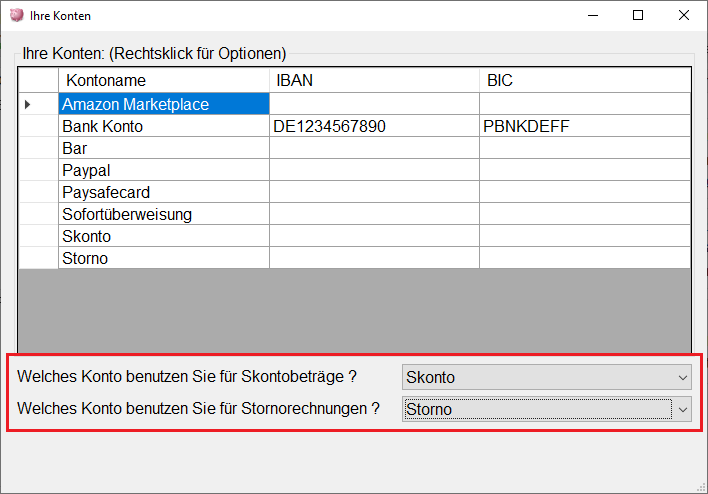

In order for the amounts to be shown correctly in the reports, the assignment to the "Discount" and "Cancellation" account must be correctly assigned. To do this, click on "My Accounts" after starting the software. Select the account for discount amounts and cancellation invoices here.

Does this help you ? --No--