Support - frequently asked questions

Income Excess Calculation

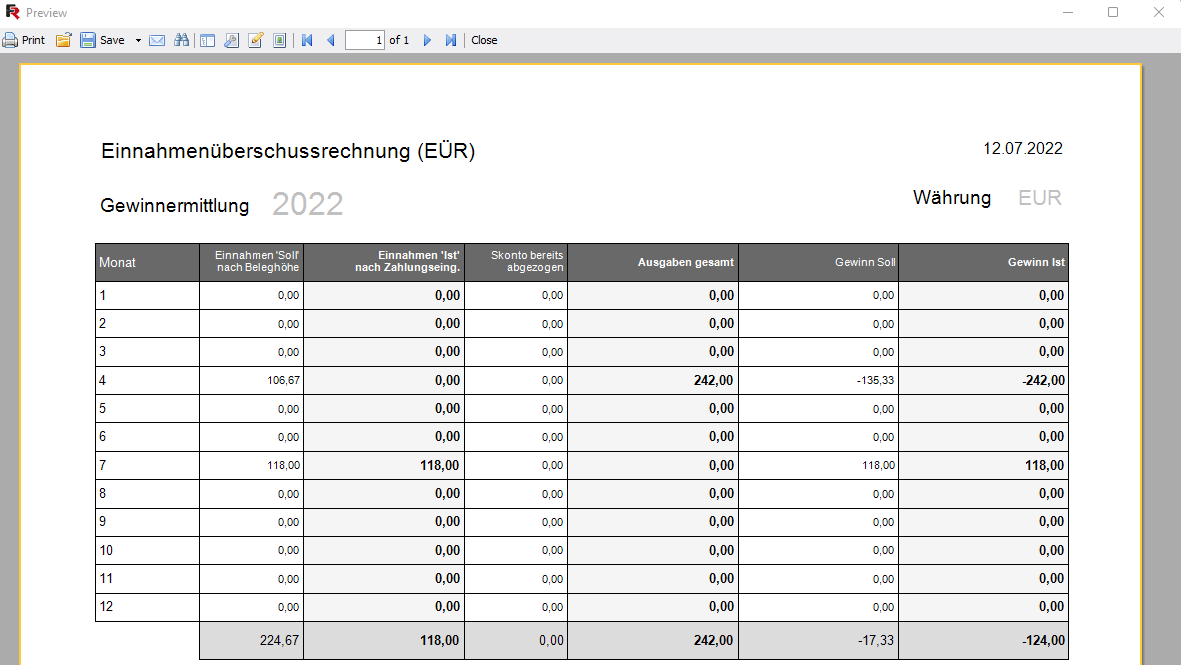

Income Excess CalculationTo do this, go to "Reports" and then select "Income Excess Invoice". An evaluation for the selected year will then open.

In the evaluation, the expenses are taken into account on the date on which you entered them. The income is shown twice. Once according to "target" and once according to "actual". That means once after the date when you wrote the invoice and as it should be in an income surplus invoice after the date when the payment was made by the customer ("actual").

So if you maintain the payments from the customers, you can see what your current surplus is in the "Actual Profit" column.

Does this help you ? --No--